Tesla’s Q3 revenue reached $23.4 billion, falling short of the anticipated $24.06 billion, with concerns from CEO Elon Musk impacting the stock’s 9.3% decline.

Tesla’s Q3 Earnings: A Deep Dive into the Numbers and Musk’s Concerns

Financial Highlights:

-

- Tesla reported a Q3 revenue of $23.4 billion, missing the analysts’ projection of $24.06 billion.

- Adjusted earnings per share (EPS) stood at $0.66, compared to the expected $0.74.

- The company’s adjusted net income was $2.3 billion, falling short of the anticipated $2.56 billion.

Margin Pressures:

-

- Tesla’s Q3 gross margin was 17.9%, slightly below the Wall Street estimate of 18.0%.

- The previous quarter had seen a gross margin of 18.2%.

- The reduced profitability is attributed to Tesla’s cost-cutting initiatives started the previous year.

Stock Impact and Analyst Reactions:

-

- Tesla stock experienced a 9.3% dip post-earnings release.

- Wedbush analyst Dan Ives reduced Tesla’s price target from $350 to $310 after the Q3 report.

- Goldman Sachs analyst Mark Delaney also lowered his Tesla price target from $265 to $235.

Cybertruck Updates:

-

- Cybertruck deliveries are set to commence on Nov. 30.

- Elon Musk anticipates a 12 to 18-month timeframe for the Cybertruck to become cash-flow positive.

- By 2025, Musk expects a production run rate of 250,000 units annually for the Cybertruck.

Production and Delivery Goals:

-

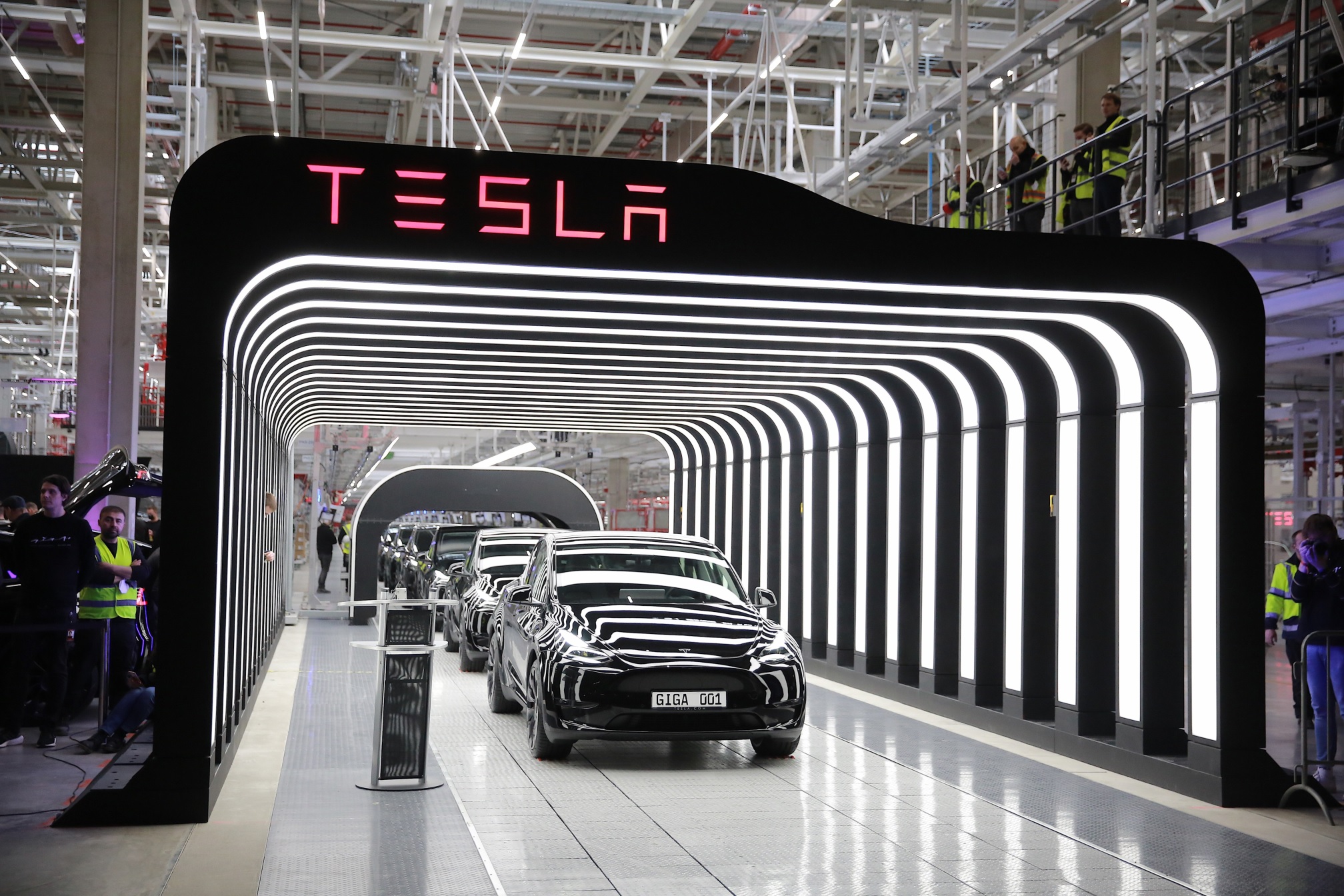

- Tesla reiterated its 2023 production target of 1.8 million vehicles.

- The company has delivered approximately 1.3 million vehicles globally in the first three quarters of 2023.

- To achieve its annual goal, Tesla would need to deliver around 500,000 vehicles in the final quarter.

Musk’s Economic Concerns:

-

- Musk expressed reservations about the global economy, particularly the rising interest rates.

- He emphasized the need to assess global economic conditions before fully committing to the Giga Mexico factory construction.

Conclusion

Despite the Q3 earnings miss, analysts like CFRA’s Garrett Nelson remain optimistic about Tesla’s future, especially regarding the Cybertruck’s production ramp-up and the company’s position in the EV market.